The 30-Minute Trading Routine For Busy People

In today’s fast-paced world, where time is a precious commodity, many people aim to use every minute of their day efficiently. Financial market trading is no different. While it’s often thought that successful trading demands a significant time commitment, the right approach can turn even 30 minutes of trading a day into a foundation for profitability. This article will show you how to plan your 30-trading routine to fit into these short time periods without losing effectiveness.

30-Minute Trading Step-by-Step

1. Getting Ready (10 minutes)

The first ten minutes are super important to kickstart your trading day. Here’s what you can do.

Market Analysis: Review the news and reports that may impact the markets you are trading in. Use news aggregators and economic calendars to stay informed about important events of the day.

Select Assets for Trading: Identify the most promising assets based on your preliminary analysis. Prioritize those demonstrating high volatility and liquidity.

Economic Calendar

2. Planning Your Trades (10 minutes)

Take the next ten minutes to draft a solid trading plan.

Entry and Exit Points: Use technical analysis to spot crucial support and resistance levels for your chosen assets. Spend about half your time checking out the long-term trends on higher timeframes, then dive into short-term movements on lower timeframes. This helps you figure out if it’s a good time to jump into a trade based on what’s happening in the market.

Position Size: Figure out your position size beforehand, considering your capital management strategy and a reasonable risk level for each trade. This avoids the need to make snap decisions during trading and keeps you from taking on more losses than necessary. Planning your trade size in advance lets you stay focused on the market without getting bogged down in calculations during crucial moments.

Identifying support and resistance levels

3. Execution and trade management (10 minutes)

The final ten minutes are crucial for active engagement and managing your positions.

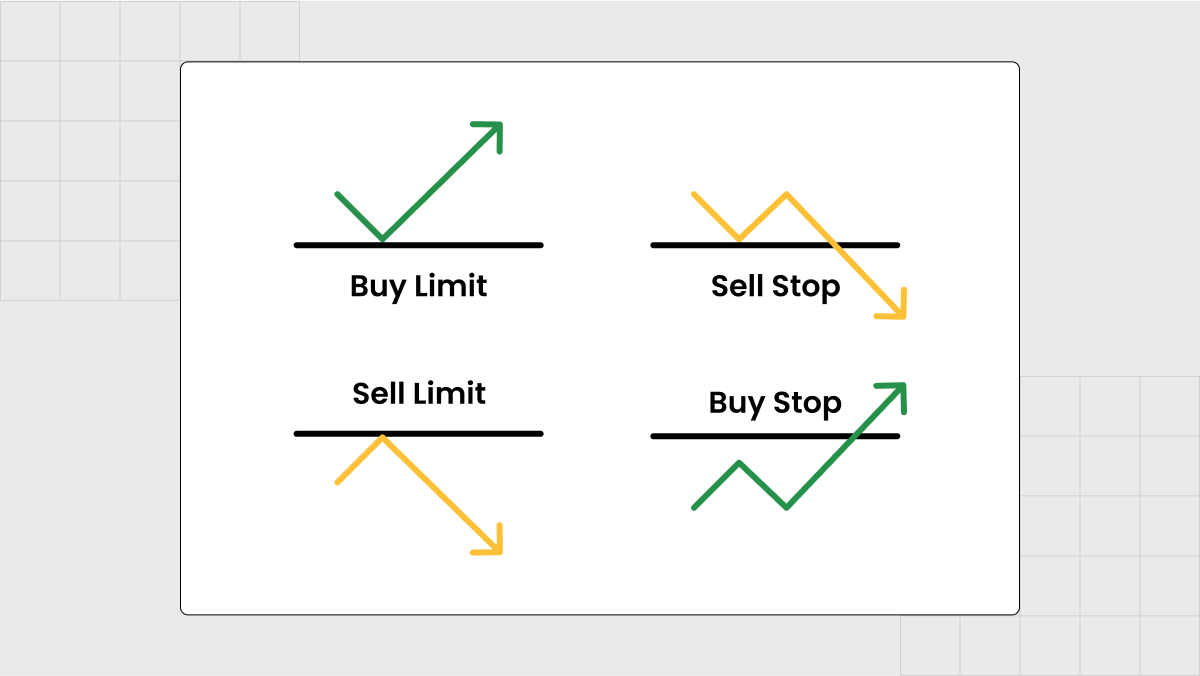

Trade Execution: Act in line with your trading plan, triggering buys or sells. Use market orders or pending orders based on your strategy.

Monitoring and Adjustment: Stay updated on the market situation throughout the day. If things aren’t going your way, be ready to change your plan, even if it means closing deals earlier than you intended to.

Types of pending orders

Note: Remember, sometimes it’s just better to skip trading altogether. Use those 30 minutes each day not only to make trades but also to check out the market and plan for future sessions. If there are no good entry points, it’s smarter to hold off on trading and focus on other parts of your life. The main goal for a trader is to nail down high-quality and profitable trades, not just rack up the quantity.

30-Minute Trading Strategies

Picking a trading strategy is like choosing your own path — it depends on what you like and what works for you. Here are some strategies that might be handy for busy people.

Swing Trading: Ideal for those seeking opportunities in trends. It allows for weekly analysis and executing trades with established risk management, minimizing the time spent in the market.

Day Trading: Choose assets with good daily volatility for short-term trades. Skillful risk management is a key factor in reducing the time spent on trading.

Algorithmic Trading: An ideal option for automation. Trading with algorithms minimizes the need for your direct involvement, requiring only periodic checks and adjustments of settings.

These strategies make trading easier for busy people, letting them save time. Besides, it’s suggested to avoid the scalping approach because it needs a lot of time and attention, which might not match the ‘quick and efficient’ trading goals.

Benefits of Trading for 30 Minutes a Day

This trading approach brings some great perks, letting traders strike a balance between work and personal life, improving discipline, and reducing stress. Here are the key benefits of such an approach.

Time Optimization: Time savings enable traders to dedicate more time to personal matters and responsibilities, enhancing the quality of life.

Discipline: Limited time helps traders be more focused and organized, increasing trading efficiency.

Stress Reduction: This approach helps reduce stress by limiting information overload and minimizing the impact of emotions on the decision-making process.

Balanced Lifestyle: Traders can easily combine trading with personal life, maintaining healthy relationships and hobbies.

Risk Reduction: A focused approach to trade selection promotes a more critical attitude towards risks and the choice of strategies.

Daily Trading Routine Examples

Establishing a structured daily trading routine is crucial for traders across various styles, whether they engage in day trading, swing trading, or rely on algorithmic strategies. The following examples outline a 30-minute trading routine tailored to each approach, offering a glimpse into how traders can adapt these routines to enhance their daily trading efficiency.

From quick macroeconomic analyses and detailed asset evaluations to adjusting algorithms for current market conditions, these routines serve as valuable frameworks for traders seeking consistency and effectiveness in their trading activities.

For Day Traders

5 minutes: Quick macroeconomic analysis using pre-selected sources and an economic calendar.

15 minutes: Detailed analysis of selected assets, determining entry and exit points for trades.

5 minutes: Execution of market trades or placement of pending orders.

5 minutes: Planning for the next day, including strategy adjustments and preparation for the upcoming trading session.

For Swing Traders

10 minutes: Weekly asset selection based on market analysis, with special attention to trend changes, news, and reports.

10 minutes: Determining position size and entry/exit points for trades.

5 minutes: Monitoring open positions and adapting the strategy to current market conditions.

5 minutes: Analyzing results and adjusting the approach based on the obtained data.

For Algorithmic Traders

10 minutes: Checking the efficiency of algorithms and analyzing trades from previous sessions.

10 minutes: Adjusting algorithms to current market conditions, including asset adjustments for trading.

10 minutes: Testing new strategies and algorithms, exploring alternative automated solutions to enhance trading.

These examples illustrate how traders with different approaches can adapt a 30-minute trading routine to their daily schedules. We hope this information proves helpful in optimizing your daily trading routine.

FAQ

Is a 30-minute chart suitable for day trading?

Trading for 30 minutes a day can be an effective strategy if a trader can quickly analyze the market and make informed decisions. This approach requires a good understanding of market trends and precise timing, as the short time frame limits the number of possible trades and increases the importance of each choice. However, with the right approach and strategy, 30 minutes a day can be sufficient for successful trading.

What is the strategy for the first 30 minutes of a trading day?

The trading strategy begins with thorough preparation, including analyzing news and selecting assets with high movement potential. Traders then identify target instruments and carefully observe the formation of trends and patterns that indicate optimal entry and exit points for trades. This approach requires quick reactions and readiness to make instant decisions based on market dynamics, with positions being closed within the day with set profit targets and risk limits.

What are the benefits of trading for 30 minutes a day?

Trading for just 30 minutes a day has its perks. It's perfect for people with busy lives since it leaves room for relaxation and stress relief. Plus, it helps you become more disciplined in your trading approach. The limited daily time keeps you focused, leading to better strategies and potentially higher returns. It also cuts down on unnecessary trades, saving you money. In simple terms, spending 30 minutes a day on trading fits smoothly into your routine. It builds a solid yet flexible foundation for a healthy trading mindset and improves overall market efficiency.

Conclusion

This article shows that achieving success in the market is possible even with limited time. It emphasizes the importance of discipline, strategic planning, and effective time management. This approach enables traders to achieve results while maintaining a balanced lifestyle and minimizing stress, making trading accessible and productive for busy individuals striving for financial success.